Free CMFAS M8 Mock Exam Questions & Papers (2026 Calculation Examples)

Looking for free CMFAS M8 mock exam questions? We break down 5 tricky calculation and concept examples (Time Value of Money, Sharpe Ratio, Risk) from the 2026 syllabus.

If you are preparing for the M8 exam, the "Theory" chapters (1-3) are usually manageable. The real danger zone is Chapter 4 (Risk) and Chapter 5 (Time Value of Money).

M8 requires you to memorize specific financial formulas that are not provided in the exam. If you cannot calculate Future Value or Sharpe Ratio from memory, you will likely fail. (See our 2026 M8 study guide for more details.)

Most free notes online skip the math. Below, we have created a free mini-mock covering the 5 specific question types that trip up most agents.

✨ TL;DR: The "Math" Trap

- The Formulas: You must memorize Future Value, Sharpe Ratio, and Information Ratio.

- The Concepts: Understand "Money Market" maturity and "Risk Tolerance" triggers.

- The Fix: Practice calculations until you stop mixing up the denominators.

🧮 Question 1: Time Value of Money (Chapter 5)

Question:

An investor has purchased a house for S$400,000. It is expected to grow at a compound rate of 2% annually. Calculate the value of the house after 17 years, to the nearest S$1,000.

- A) S$536,000

- B) S$560,000

- C) S$596,000

- D) S$620,000

The Trap: Calculation errors with powers/exponents.

The Correct Answer: B ($560,000)

The Logic:

Use the Future Value formula: FV = PV * (1 + r)^n

- PV = $400,000

- r = 0.02

- n = 17

- Calculation: $400,000 * (1.02)^17 = $560,090 (Rounded to $560,000).

ExamPrep.sg provides instant feedback and explanations for every question so you don't panic.

---

📈 Question 2: Sharpe Ratio (Chapter 4)

Question:

The annualised return for a fund is 6% while the return on the benchmark is 5%. The risk-free rate is 2%. Standard deviation and tracking error are 5% and 3% respectively.

Calculate the Sharpe Ratio.

- A) 0.3

- B) 0.5

- C) 0.6

- D) 0.8

The Trap: Confusing Standard Deviation (used for Sharpe) with Tracking Error (used for Information Ratio).

The Correct Answer: D (0.8)

The Logic:

- Formula: (Fund Return - Risk-Free Rate) / Standard Deviation

- Calculation: (6% - 2%) / 5% = 4% / 5% = 0.8.

(Note: If you used Tracking Error (3%), you would get 1.33, or if you used Benchmark (5%), you would get the wrong answer).

---

📊 Question 3: Information Ratio (Chapter 4)

Question:

A unit trust generates a return of 10% and the benchmark return is 8%. If the tracking error is 4%, calculate the Information Ratio of the unit trust.

- A) 0.7

- B) 0.6

- C) 0.5

- D) 0.4

The Correct Answer: C (0.5)

The Logic:

- Formula: (Portfolio Return - Benchmark Return) / Tracking Error

- Calculation: (10% - 8%) / 4% = 2% / 4% = 0.5.

Confused by Ratios?

Chapter 4 (Risk & Return) is the #1 reason candidates fail M8. Our platform has a dedicated "Practice by Chapter" mode to help you master Sharpe, Treynor, and Information Ratios.

👉 Drill M8 Math Questions📉 Question 4: Money Market Funds (Chapter 1)

Question:

Which one of the following statements regarding money market funds is FALSE?

- A) They are less sensitive to interest rate changes.

- B) They consist of fixed income securities with maturity of more than five years.

- C) They are suitable for investors with a low-risk tolerance level.

- D) They are considered a low risk investment.

The Correct Answer: B (FALSE)

The Logic: Money market funds invest in short-term, high-quality debt instruments (typically less than one year). Any security with a maturity of "more than five years" would be a Bond Fund, not a Money Market Fund.

---

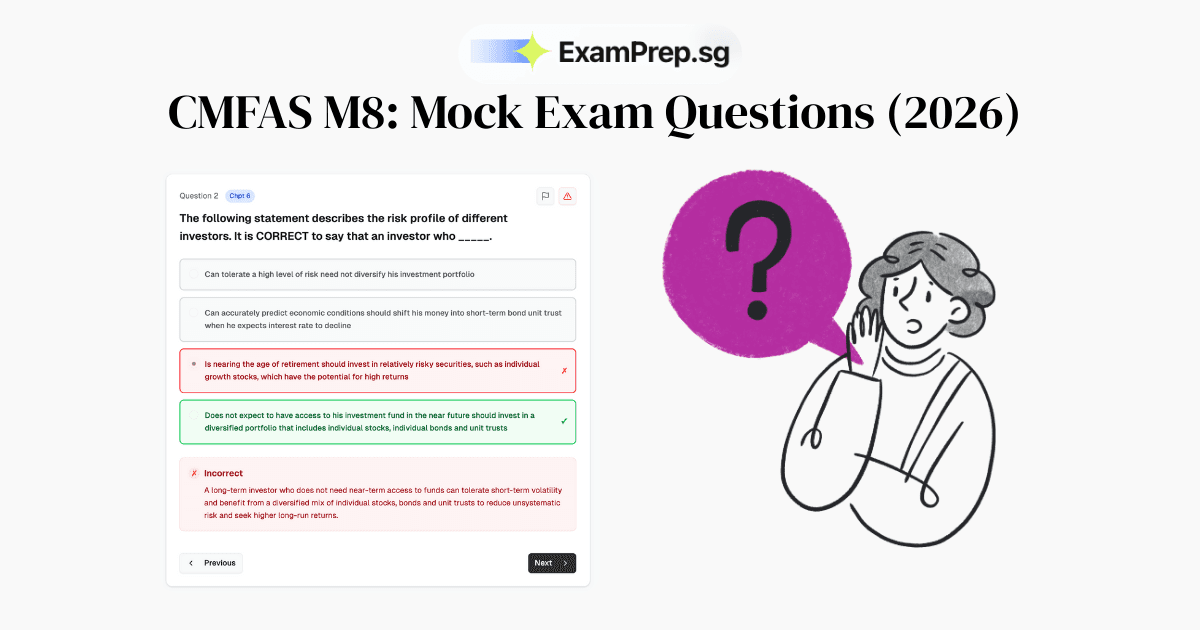

👴 Question 5: Risk Suitability (Chapter 6)

Question:

Assuming that all other factors are constant, who is LEAST suited to invest in a higher-risk investment?

- A) An investor approaching retirement age.

- B) An investor in middle age.

- C) An investor with a long investment time horizon.

- D) An investor with a high tolerance for volatility.

The Correct Answer: A

The Logic: An investor approaching retirement has a short time horizon. They have less time to recover from market crashes. Therefore, they should prioritize capital preservation over high-risk growth.

---

Why M8 is "Sneaky" Difficult

Did you get the Sharpe Ratio question right?

The exam has 50 questions. Approximately 5-8 of them will be calculations like Questions 1, 2, and 3 above. If you skip the math chapters, you are starting the exam with a handicap (See passing score and format here).

How to Fix It:

You need to practice the formulas until they become second nature. If you are thinking of buying notes from Carousell, think again. Read our guide on the best M8 mock exams and study guides here.

At ExamPrep.sg, our M8 platform includes:

- Instant Feedback & Explanations: Get instant feedback and explanations for every question.

- Practice by Chapter Mode: Focus on specific chapters and drill on your weak spots.

Use ExamPrep.sg's "Practice by Chapter" mode to focus on specific chapters.

- Progress Tracker: Track your progress and monitor your improvements over time.

Track your progress and see your weak spots and improvements over time.

- AI Weakness Detection: Identify your weak spots and focus on them.

Identify your weak spots and focus on them.

- 2026 Syllabus: Updated for the latest CM-CIS requirements.

Don't leave your pass/fail result to chance.

Common Questions on M8 Mock Exams

By The ExamPrep.sg Team

Singapore's leading CMFAS and SCI exam preparation platform, helping thousands of candidates pass their financial adviser exams on the first try.

Ready to Put This Strategy Into Action? 💯

Practice M8 calculation questions with our M8 Exam Platform. Start practicing now.