How to Pass CMFAS M9 Exam Singapore: Complete 2026 Study Guide

Struggling with the 17 chapters of CMFAS M9? We break down the "Killer Topics" (Calculations & Law), the 2026 syllabus changes, and a 4-week plan to pass on your first try.

The CMFAS M9 (Life Insurance and Investment-Linked Policies) exam is widely considered the "gateway" paper for financial advisors in Singapore. It is also the first part of the CM-LIP exam. (If you haven't booked your slot yet, read our M9 Registration Guide here).

Unlike the RES 5 exam, which focuses heavily on ethics and conduct, the M9 exam is a test of Technical Knowledge. It requires you to master two things that most candidates hate: Mathematics (Premium Calculations) and Law (Wills, Trusts, and Agency).

If you are trying to memorize the official 300-page SCI textbook word-for-word, you are studying inefficiently. (See our review of the best M9 study tools & mock exams here).

This guide covers the 2026 syllabus strategy, the "Killer Chapters" you must focus on, how to handle the calculation questions without panicking, and why you should probably NOT take the combined CM-LIP exam.

📝 Note: The SCI syllabus features a minor revision effective 24 Feb 2026. Our premium question bank and mock exams have already been fully updated to reflect these latest changes.

✨ TL;DR: The M9 Passing Strategy

- The Scope: 17 Chapters covering Life Insurance, ILPs, and Contract Law.

- The Trap: "Calculation" questions (Ch 2 & 9) and "Law" questions (Ch 14 & 15).

- The Score: You need 70% (70/100 Questions) to pass.

- The Strategy: Take M9 and M9A separately to "lock in" your passes.

The "CM-LIP" Trap: Should You Combine M9 & M9A?

Most agencies will ask you to register for CM-LIP (which combines M9 and M9A into one 3-hour paper).

We strongly advise NEW agents to take them separately.

Why? The "Double Jeopardy" Rule:

In the combined CM-LIP exam, you must pass Part I (M9) AND Part II (M9A) in the same sitting.

- If you score 90% on M9 but fail M9A (which is very common due to complex derivative questions), you FAIL the entire exam.

- You lose your M9 score and must retake everything.

The "Lock-In" Strategy:

Although taking them separately costs slightly more (approx. $100 difference), it allows you to "Save Game." Once you pass M9, it is yours forever. You can then focus 100% of your energy on the difficult M9A derivatives without the stress of losing your M9 license.

Understanding the Beast: M9 Exam Format (2026)

The M9 exam is often taken together with M9A (Investment-Linked Policies II) to form the CM-LIP requirement, but they are distinct exams.

- Format: 100 Multiple Choice Questions (MCQ).

- Duration: 2 Hours.

- Passing Score: 70% (You need 70 correct answers) (Read our full breakdown of the M9 Passing Score & Format here).

- Calculators: Allowed (and necessary). SCI does not provide them; you must bring an approved model. Approved calculator models can be found here.

While 70% sounds achievable, the sheer volume of content (17 Chapters) makes retention difficult. Many candidates score 65% because they "blank out" on the specific calculation formulas or legal definitions during the exam.

The "Killer Chapters": Where Most Candidates Fail

The M9 exam difficulty isn't evenly distributed. Some chapters are "common sense," while others are technical minefields.

1. The Calculation Trap (Chapters 2 & 9)

You cannot just "guess" these. You need to know the formulas.

- Chapter 2 (Setting Premiums): You must understand Gross vs. Net Premium, Mortality tables, and Loading.

- Chapter 9 (ILP Computations): This is often the hardest chapter. You need to calculate Net Asset Value (NAV), Bid/Offer Spread, and Forward/Backward Pricing.

* *Example:* "If the Offer Price is $1.50 and the Bid-Offer Spread is 5%, what is the Bid Price?"

2. The "Law" Jungle (Chapters 14, 15, & 17)

These chapters read like a law degree textbook.

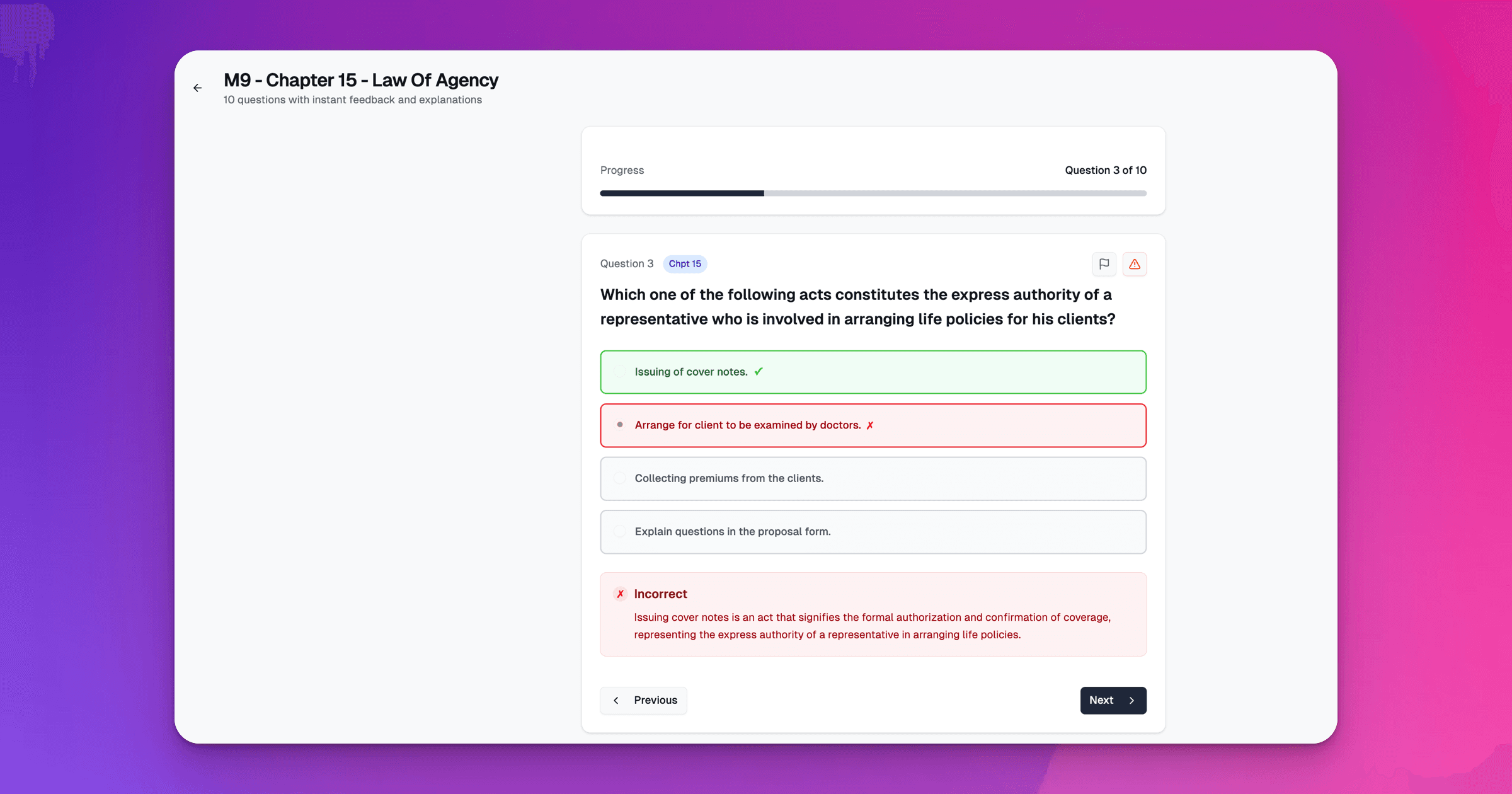

- Chapter 15 (Law of Agency): You need to distinguish between Actual Authority, Apparent Authority, and Ratification.

- Chapter 17 (Wills & Trusts): Understanding the Insurance Nomination Act (Section 49L vs 49M) is non-negotiable. You will see scenario-based questions asking which specific section applies to a client's nomination.

Your 4-Week "Math & Law" Study Plan

To pass M9, you need to split your time between Understanding Concepts and Drilling Math.

Week 1: The Basics (Chapters 1, 3, 4, 5, 6, 10)

- Focus: Product Knowledge.

- Topics: Types of Life Insurance (Term, Whole Life, Endowment), Riders, and Annuities.

- Strategy: These are fact-based. Read the notes and do simple quizzes to retain the definitions.

Week 2: The "Law" Deep Dive (Chapters 11-17)

- Focus: Underwriting, Claims, and Law.

- Topics: Utmost Good Faith, Insurable Interest, and the Nomination of Beneficiaries.

- Strategy: These are dense. Use our Practice by Chapter mode to drill "Law of Agency" questions until you stop confusing the terms.

Stop wasting time on topics you already know. Use ExamPrep.sg's "Practice by Chapter" mode to drill specific chapters until you are satisfied with your score.

Week 3: The "Math" Intensive (Chapters 2, 7, 8, 9)

- Focus: Premium Calculation & ILP Math.

- Strategy: Stop reading. Start calculating.

* Do not just look at the formula.

* Take a blank piece of paper and try to solve calculation questions (try these 5 free M9 calculation examples first).

* If you get one wrong, read the explanation to understand where your math broke down.

🧮 Weak at Math? Don't risk it.

Our ExamPrep.sg platform includes a dedicated "Practice by Chapter" mode that allows you to drill specific chapters until you are confident with your score.

👉 Start Your M9 Practice

Calculation questions are tedious. With ExamPrep.sg, you can practice them until you are confident with your score.

Week 4: Full Simulation

- Focus: Time Management.

- Activity: Take at least 3 full-length mock exams (100 questions each).

- Goal: Finish in 1 hour 45 minutes to leave 15 minutes for checking your "Flagged" questions.

Track your progress and see your improvements over time.

Summary: Respect the Math

M9 is not just about memorizing product features. It is about proving you can calculate the value of a policy and understand the legal contract behind it.

If you rely on old notes that don't explain the steps for the calculation questions, you will struggle in the exam hall.

Ready to start practicing?

Check out our M9 Mock Exam Simulator to get instant feedback on your calculation and legal knowledge.

Frequently Asked Questions About M9 Exam

By The ExamPrep.sg Team

Singapore's leading CMFAS and SCI exam preparation platform, helping thousands of candidates pass their financial adviser exams on the first try.

Ready to Put This Strategy Into Action? 💯

Join thousands of successful candidates who have passed their M9 exam using our proven study methods.