How to Pass CMFAS HI (Health Insurance) Exam: 2026 Guide & Updates

The CMFAS HI (Health Insurance) exam has changed. With the April 2025 MediShield Life updates, old notes are now dangerous. Here is your guide to the new claim limits, Healthcare Financing, and passing on the first try.

If you think the Health Insurance (HI) exam is just about memorizing "Medisave limits," you are in for a rude shock.

The Singapore healthcare landscape underwent a massive overhaul in April 2025.

- MediShield Life claim limits increased (e.g., Daily Ward limits rose from $1,000 to $1,630).

- Deductibles were revised.

- Cancer Drug Lists (CDL) are now heavily tested.

If you are studying with notes from your senior (dated 2023 or 2024), you are memorizing wrong numbers. (See our review of the best HI study tools & mock exams here to find updated materials). You will calculate the claim amount incorrectly, and you will fail.

This guide covers the 2026 Syllabus, the new "Killer" limits you must memorize, and how to navigate the complex Healthcare Financing framework.

📝 Note: The SCI syllabus features a minor revision effective 24 Feb 2026. Our premium question bank and mock exams have already been fully updated to reflect these latest changes.

✨ TL;DR: The "April 2025" Trap

- The Update: MediShield Life limits increased significantly in April 2025.

- The Risk: Old notes usually list the old $1,000 daily limit. The new limit is $1,630.

- The Killers: Chapter 2 (Medical Expense Calculations) and Chapter 9 (Healthcare Financing).

- The Score: 50 Questions / 70% Pass. You can only afford 15 mistakes. (See our HI Registration Guide for fees and dates).

The "Killer" Chapters (Where Marks are Lost)

The HI exam is short (50 Questions / 1 Hr 15 Mins), but it is dense. (See our breakdown on the difficulty of the HI exam here). We have identified the two chapters that makes up a bulk of the exam questions. Most candidates fail because they underestimate these two specific chapters:

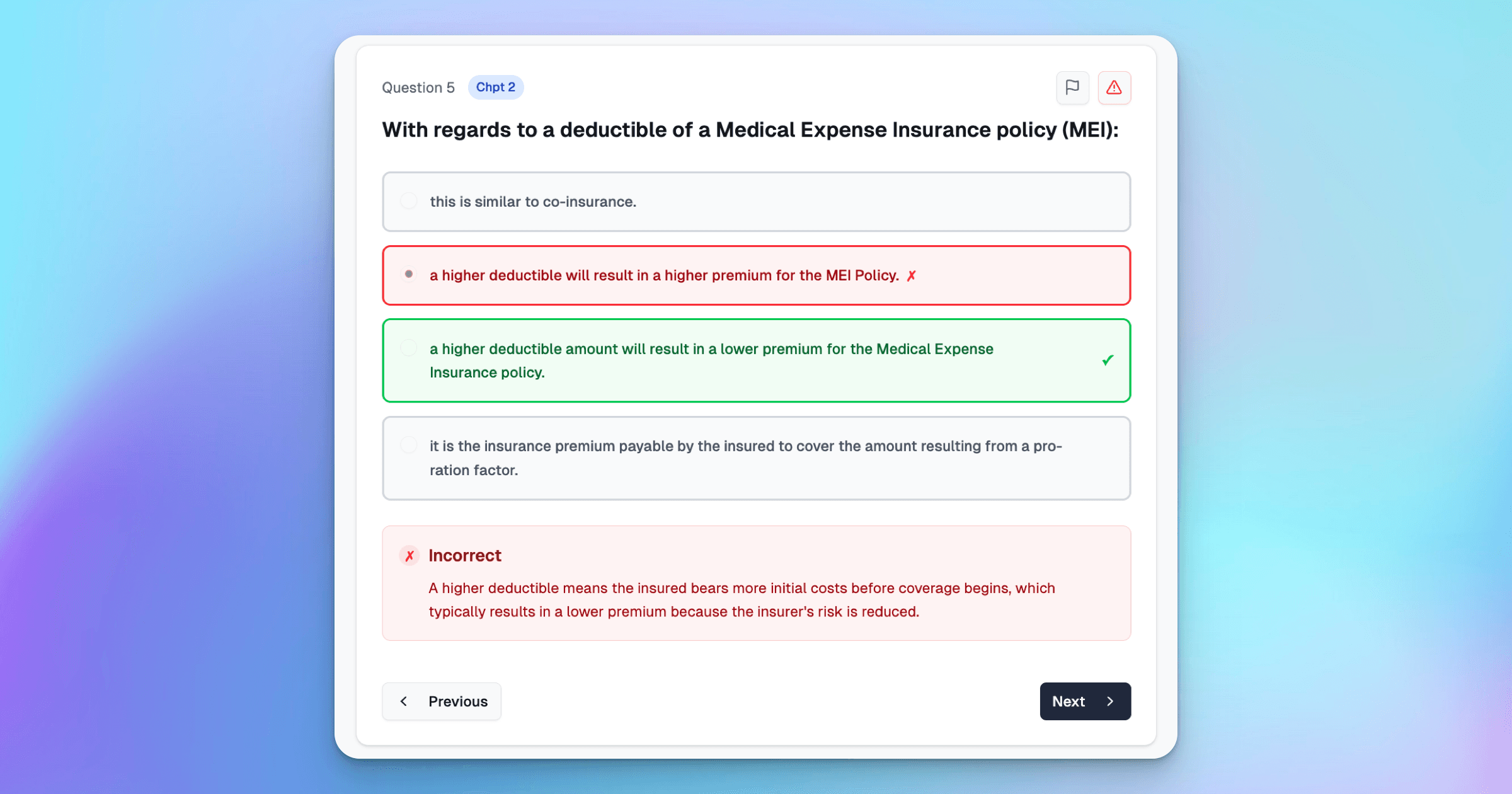

1. Medical Expense Insurance (Chapter 2) - The Math

This is the calculation heavy-weight. You will be given a hospital bill (e.g., $50,000 at a Private Hospital) and asked to calculate the Claimable Amount.

- The Formula: Bill × Pro-Ration Factor - Deductible - Co-Insurance = Payout.

- The Trap: You must know the exact 2026 deductible for a Class A/Private ward. If you use the old 2024 figure, your answer is wrong.

We have created a free mini mock exam to help you test your knowledge of the new syllabus.

2. Healthcare Financing (Chapter 9) - The "System"

This chapter tests your knowledge of the "3Ms" framework. You must distinguish between:

- MediSave: A savings account with strict Withdrawal Limits (e.g., $550/day for inpatient).

- MediShield Life: An insurance scheme with Claim Limits (e.g., $200,000/year).

- Medifund: The safety net for the needy (Means-tested).

Why Chapter 9 is dangerous: The exam will ask scenario questions like: "Mr. Tan's bill is $10,000. How much can be paid from MediShield vs. MediSave?" You need to apply both sets of limits simultaneously.

📉 Using 2024 Notes? Stop.

The April 2025 limit changes mean almost every calculation in your old notes is wrong. Our simulator is updated with the latest $1,630 Ward Limit and new deductible tiers.

👉 Practice Updated HI Questions

Don't study outdated notes. Our simulator is fully updated with the latest changes, with instant feedback and explanations.

The "Alphabet Soup" of Shield Plans

To pass, you must also master the interaction between government schemes and private insurance.

Integrated Shield Plans (IPs)

- What it is: Private insurance (AIA, Pru, etc.) that sits on top of MediShield Life.

- The "Pro-Ration" Factor: If a subsidized patient stays in a private ward, you must apply the correct Pro-Ration Factor before calculating the claim. This is a guaranteed exam question.

CareShield Life vs. ElderShield

- The Confusion: You need to know who is on which scheme.

- The Trigger: CareShield payouts start when you cannot perform 3 out of 6 Activities of Daily Living (ADLs). If the question says "2 ADLs," the answer is $0 payout.

Your 3-Week HI Study Plan

Week 1: The Framework (Chapters 1, 9)

- Focus: Healthcare Financing.

- Activity: Memorize the MediSave Withdrawal Limits vs. MediShield Claim Limits. They are different numbers. Write them down side-by-side.

Week 2: The Products (Chapters 2-7)

- Focus: Medical Expense & Disability.

- Activity: Use our HI Exam Simulator to practice "Bill Calculation" questions. Ensure you can calculate a claim payout in under 2 minutes.

Struggling with Calculations? Isolate Chapter 2 and drill it until you master the formulas.

Week 3: Case Studies (Chapter 15)

- Focus: Application.

- Activity: You will get a client profile (Age 45, PR, Private Hospital stay). You must recommend the right plan or calculate the out-of-pocket cash required.

See your progress and track your weak spots. Our AI Recommendation Engine identifies your weak spots and creates a custom practice plan to help you master them.

Summary: It's a Memory Game

The difficulty of HI isn't logic; it's Accuracy.

You either know the limit is $1,630, or you don't. There is no middle ground.

Don't let outdated notes cost you your license.

Ready to test your memory?

Try our updated diagnostic quiz to see if you are using the 2025 or 2026 numbers.

Common Questions on HI Exam

By The ExamPrep.sg Team

Singapore's leading CMFAS and SCI exam preparation platform, helping thousands of candidates pass their financial adviser exams on the first try.

Ready to Put This Strategy Into Action? 💯

Test your knowledge of the new 2025/2026 Health Insurance limits with our AI Simulator.