Free CMFAS M8A Mock Exam Questions & Papers (2026 Syllabus & Examples)

Test your knowledge on the M8A killer concepts: currency risk calculation, structured product suitability, and basis calculation for futures contracts.

The CMFAS M8A exam is technically demanding, requiring fluency in derivatives, structured product valuation, and foreign exchange impact. Unlike M8, the questions here often involve multi-step calculations and deep conceptual understanding of risk (Read our full study guide here: How to Pass CMFAS M8A Exam).

If you cannot solve these questions quickly and accurately, you are risking a retake. We have curated 5 critical mock questions—including tricky calculations—to test your readiness for the exam.

⚠️ M8A Question Difficulty Checklist

- Calculation: Foreign Exchange risk (Question 2)

- Concept: Structured Product Suitability (Question 1)

- Derivatives: Basis Calculation (Question 4)

- Read more about the killer chapters here: Is the CMFAS M8A exam difficult?

---

Question 1: Structured Product Risk Assessment (Chapter 2)

Question:

Jia Yi invested S$150,000 in a structured deposit issued by a local bank with an AA credit rating. She will be LEAST concerned with:

- A) Liquidity risk

- B) Foreign exchange risk

- C) The credit rating of issuer

- D) The value of the underlying assets in the derivative contract

The Trap: Confusing local issuance (low FX risk) with issuer risk (which is always present).

The Correct Answer: B (Foreign exchange risk)

The Logic: Because the structured deposit is issued locally and denominated in the domestic currency (SGD), there is negligible currency exposure, making foreign exchange risk the least relevant concern among the choices. The credit rating (C) and liquidity (A) are always concerns for structured products.

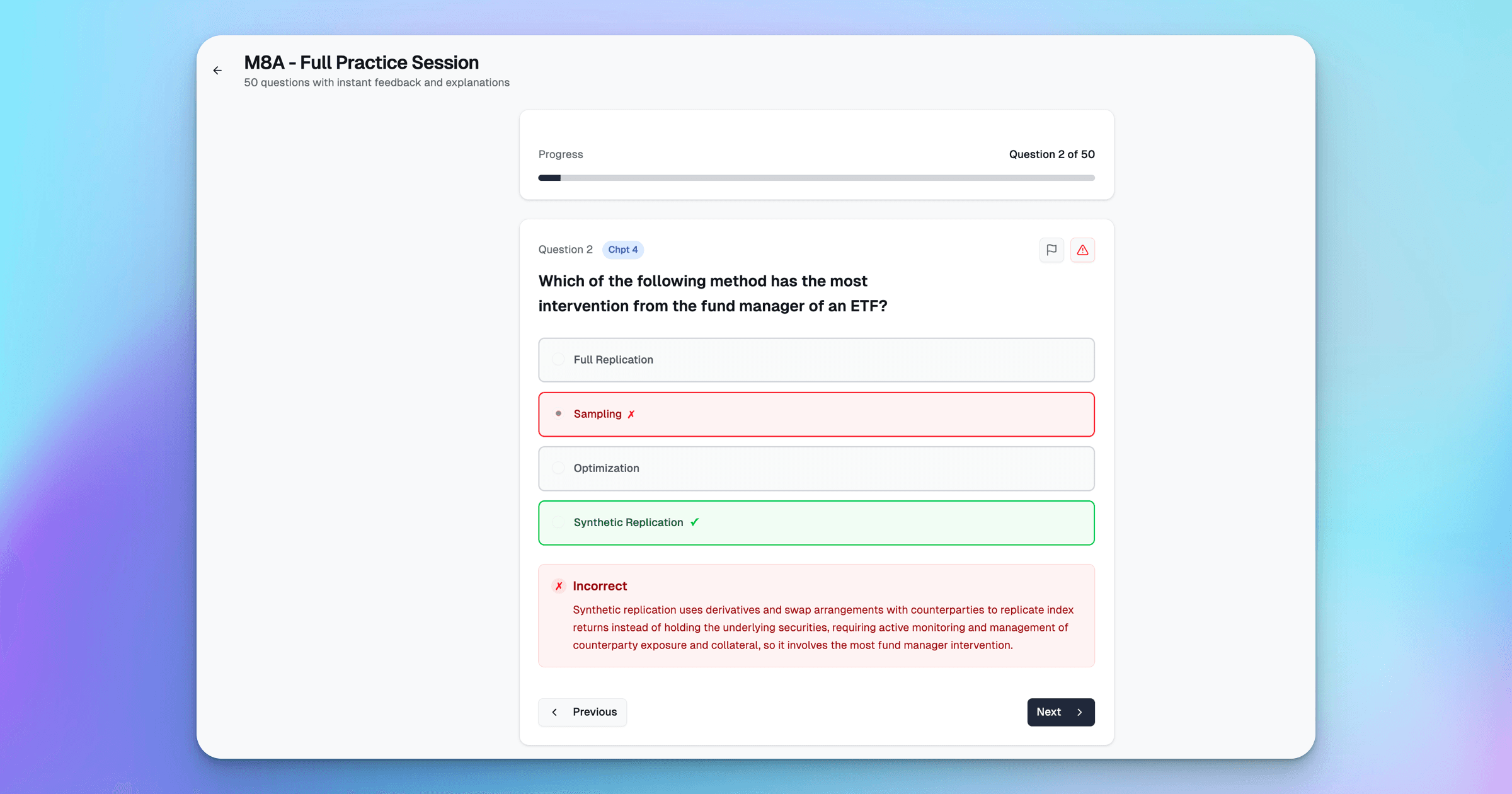

ExamPrep.sg provides instant feedback and explanations to help you understand the concepts better.

---

📈 Question 2: FX Conversion Calculation (Chapter 2 / 5)

Question:

S$100,000 is invested in an Australian dollar-denominated investment. Current exchange rate is AUD$1 is to S$1.40. At maturity, the investment has gained 10%, and the exchange rate is now AUD$1 is to S$1.20. What is the percentage return after converting back to S$?

- A) Loss 10%

- B) Loss 6%

- C) Gain 10%

- D) Gain 6%

The Trap: Forgetting to convert the initial SGD investment into AUD first.

The Correct Answer: B (Loss 6%)

The Logic:

- Initial Investment in AUD: S$100,000 / S$1.40 = AUD$71,428.57

- Investment Value at Maturity (AUD): AUD$71,428.57 * 1.10 = AUD$78,571.43

- Final Value in SGD: AUD$78,571.43 * S$1.20 = S$94,285.72

- Percentage Return: (S$94,285.72 - S$100,000) / S$100,000 = -5.71%

*Approximated to Loss 6%.* This shows the power of FX movements over investment gains.

---

Question 3: Unit Trust Total Fees Incurred (M8/M8A Overlap)

Question:

An investor bought a Unit Trust. The fees are: Initial Sales Charge: 5%; Management Fee: 1.5% p.a.; Redemption Fee: 2%; Other Fees: 2% p.a. If all applicable fees are charged, what is the total percentage fee incurred upon initial purchase and for the first year?

- A) 11.50%

- B) 8.50%

- C) 7.0%

- D) 5.0%

The Trap: Confusing one-time charges (Initial Sales Charge) with annual expenses (Management Fee + Other Fees).

The Correct Answer: B (8.50%)

The Logic: The total fees incurred for the first year (excluding the performance fee and redemption fee) are the sum of the upfront cost and annual charges:

- Initial Sales Charge (5.0%) + Management Fee (1.5%) + Other Fees (2.0%) = 8.5%.

M8A: You Need More Than 5 Questions

If you struggled with the above questions, your static notes are insufficient. M8A requires a simulator that breaks down the math and shows you the resulting payoff diagrams.

👉 Start Unlimited M8A Practice Now---

Question 4: Derivatives Basis Calculation (Chapter 3)

Question:

Suppose in June the futures contract for crude oil is $97.10 per barrel and the cash price (spot) is at $97.40. Calculate the basis for the month of June.

- A) 30 cents under June

- B) 30 cents over June

- C) 30 cents below June

- D) 30 cents above June

The Trap: Reversing the calculation order (Futures - Cash) or confusing the terminology ("under" vs. "over").

The Correct Answer: B (30 cents over June)

The Logic:

- Formula: Basis = Cash Price − Futures Price

- Calculation: $97.40 − $97.10 = +$0.30.

- A positive basis means the cash price is higher than the futures price, hence 30 cents over June (the futures contract).

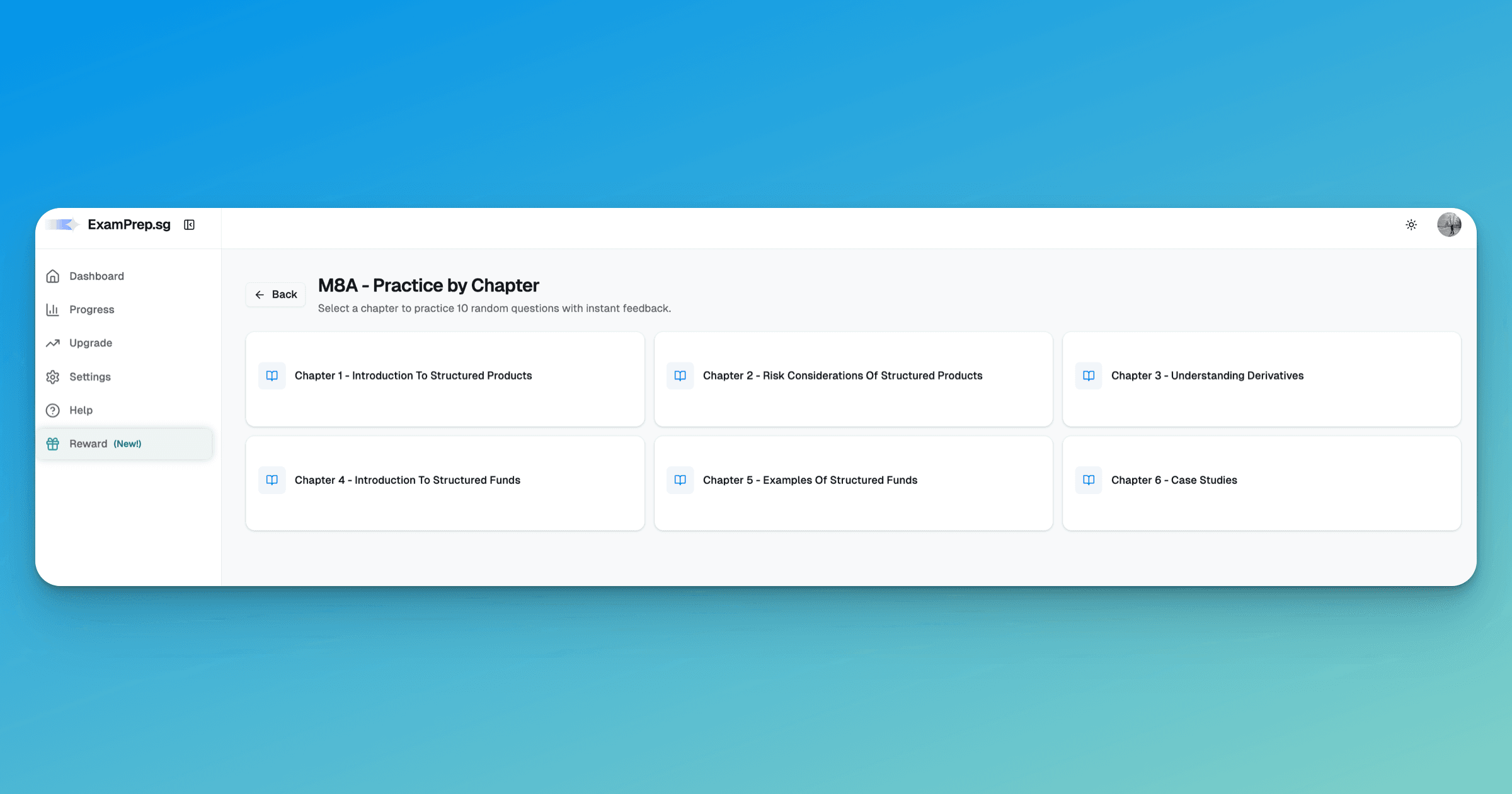

Use ExamPrep.sg's "Practice by Chapter" mode to focus on specific chapters.

---

Question 5: Structured Fund Definition (Chapter 4)

Question:

Which of the following is considered a structured fund?

- A) Hedge fund that practices short selling

- B) Fund-of-Funds that comprises of various sub-funds

- C) Index fund that tracks Dow Jones Index

- D) Fund-of-Hedge-Funds that uses derivatives

The Correct Answer: D

The Logic: Structured funds are characterized by combining financial instruments (often derivatives) to achieve a specific, often complex, risk-return profile. A fund that uses derivatives and combines multiple funds (Fund-of-Hedge-Funds) is the most accurate description of a complex structured product.

---

Use ExamPrep.sg's progress tracker to see your progress and identify your weak spots.

Why M8A is harder than M8

The exam has 50 questions. Although there are only 6 chapters, the questions are more complex and require a deeper understanding of the concepts.

How to Fix It:

You need to practice the concepts and calculations until they become second nature. If you are thinking of buying notes from Carousell, think again. Read our guide on the best M8A mock exams and study guides here.

At ExamPrep.sg, our M8A platform includes:

- Instant Feedback & Explanations: Get instant feedback and explanations for every question.

- Practice by Chapter Mode: Focus on specific chapters and drill on your weak spots.

- Progress Tracker: Track your progress and monitor your improvements over time.

- AI Weakness Detection: Identify your weak spots and focus on them.

Identify your weak spots and focus on them.

- 2026 Syllabus: Updated for the latest CM-CIS requirements. (If you're still wondering whether to buy notes from Carousell, read our guide on the best M8A mock exams and study guides here).

Don't leave your pass/fail result to chance.

Common Questions on M8A Mock Exam Questions

By The ExamPrep.sg Team

Singapore's leading CMFAS and SCI exam preparation platform, helping thousands of candidates pass their financial adviser exams on the first try.

Ready to Put This Strategy Into Action? 💯

Master the M8A calculations with our Exam Platform. Start practicing now.