Is CMFAS M8A Exam Difficult? (Why Derivatives & Structured Funds Fail Candidates)

M8A (CIS II) is widely regarded as one of the hardest papers due to its focus on Financial Engineering, Derivatives, and Structured Product valuation. Find out why it has a lower pass rate than M8.

If you've successfully conquered M8, you might assume M8A (Collective Investment Schemes II) is just more of the same. It is not.

M8A is often cited by candidates as one of the most conceptually challenging papers in the CMFAS suite. It shifts focus from Unit Trust governance to Financial Engineering, requiring a depth of understanding that static notes simply cannot provide.

The pass rate for M8A is historically lower than M8 because most candidates underestimate the mechanics of Chapters 3, 4, and 5. We have put together free mock questions (the most common and difficult ones) for you to practice here.

⚠️ The Core Difficulty: Application

- It's not about definitions: You must analyze *how* a structured product's components (bond + derivative) interact.

- Payoff Diagrams: You need to visualize the profit/loss curve for Long/Short Calls and Puts, and then map that to the final structured product's return.

- Case Studies: The suitability questions are designed to trick you by offering subtle mismatches between client risk and product leverage.

1. The Derivatives Decoy (Chapter 3)

The biggest hurdle in M8A is mastering the basics of Derivatives.

M8 briefly mentions derivatives as an investment type, but M8A delves deep into their mechanics: Futures, Forwards, Options, and Swaps—both exchange-traded and Over-The-Counter (OTC).

- The Problem with Study Notes: Textbooks can describe the payoff of a Long Call, but they cannot embed the dynamic relationship between the underlying price, the strike price, and the profit/loss curve. You must be able to calculate the maximum gain, maximum loss, and breakeven point instantly.

- The Exam Trap: Questions often test scenarios like: "What is the result if you are Long a Call and Short a Put at the same strike price?" If you haven't drawn the combined payoff, you will guess the wrong answer.

2. Deconstructing Structured Products (Chapters 4 & 5)

Structured Funds are complex because they are often built from two distinct components:

- The Principal Protection Component: Usually a zero-coupon bond.

- The Growth Component: Usually an option or a basket of options.

The difficulty lies in the fact that the two components rely on different market forces (interest rates for the bond, equity volatility for the option).

- The M8A Challenge: You will be asked: "If interest rates rise, how does the cost of the option change, and how does that affect the overall yield of the Structured Fund?" This requires multi-step analysis that is impossible to memorize.

- The Solution: You need to train your brain to instantly deconstruct a structured product into its constituent parts and understand the risk in each.

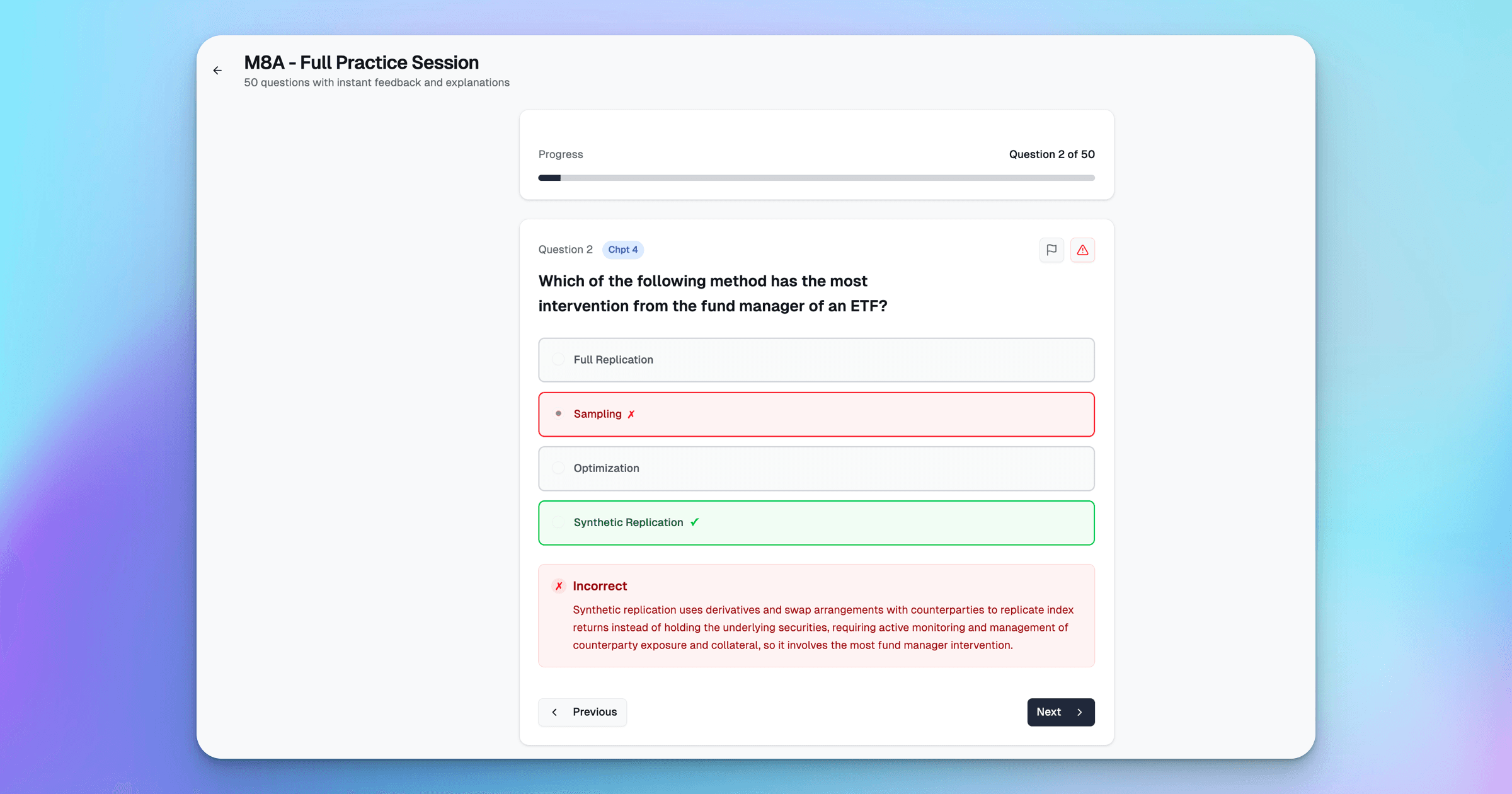

ExamPrep.sg provides instant feedback and explanations to help you understand the concepts better.

3. Case Studies: Suitability on Steroids (Chapter 6)

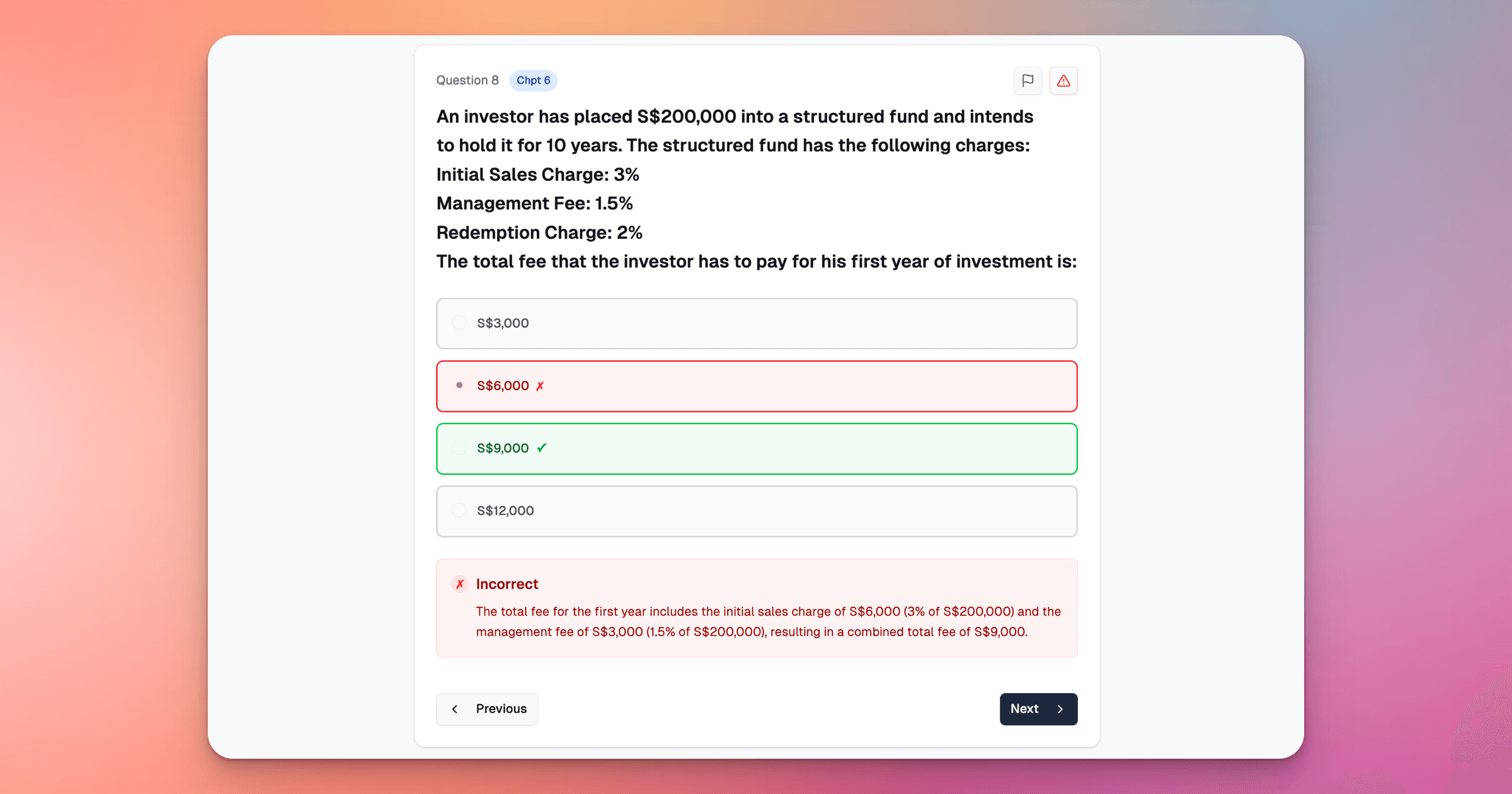

Chapter 6 is the application chapter. For example, you might be given a detailed client profile (Age, income, risk tolerance: Moderate/High) and a product that uses complex leverage (e.g., Credit-Linked Note, or an Equity-Linked Note). Or a calculation question that looks like this:

You need to understand the concepts and be able to calculate the answer in your head.

- The M8A Differentiator: The simple "low risk client = low risk product" rule from M8 does not apply. You must spot the secondary risks. For example, a Principal-Protected Note might seem safe, but if it has poor liquidity (cannot be sold easily), it is completely unsuitable for a client with a short time horizon or immediate cash needs. (If you're still wondering whether to buy notes from Carousell, read our guide on the best M8A mock exams and study guides here).

- The Test: M8A tests your ability to spot these hidden risks (credit risk of the issuer, liquidity mismatch, and volatility exposure), as well as your ability to calculate the answer if you are given a calculation question.

Need to master the M8A math?

The fastest way to pass M8A is by drilling the calculation questions in our simulator.

👉 Access M8A Mock Exams NowHow to Guarantee an M8A Pass

M8A cannot be passed by reading the textbook alone. The need to visualize payoff diagrams and calculate multi-step component risks makes a simulator mandatory.

- Stop Memorizing, Start Visualizing: Use practice questions that force you to calculate and draw the payoff. Our platform is built to simulate the dynamic relationships of derivatives.

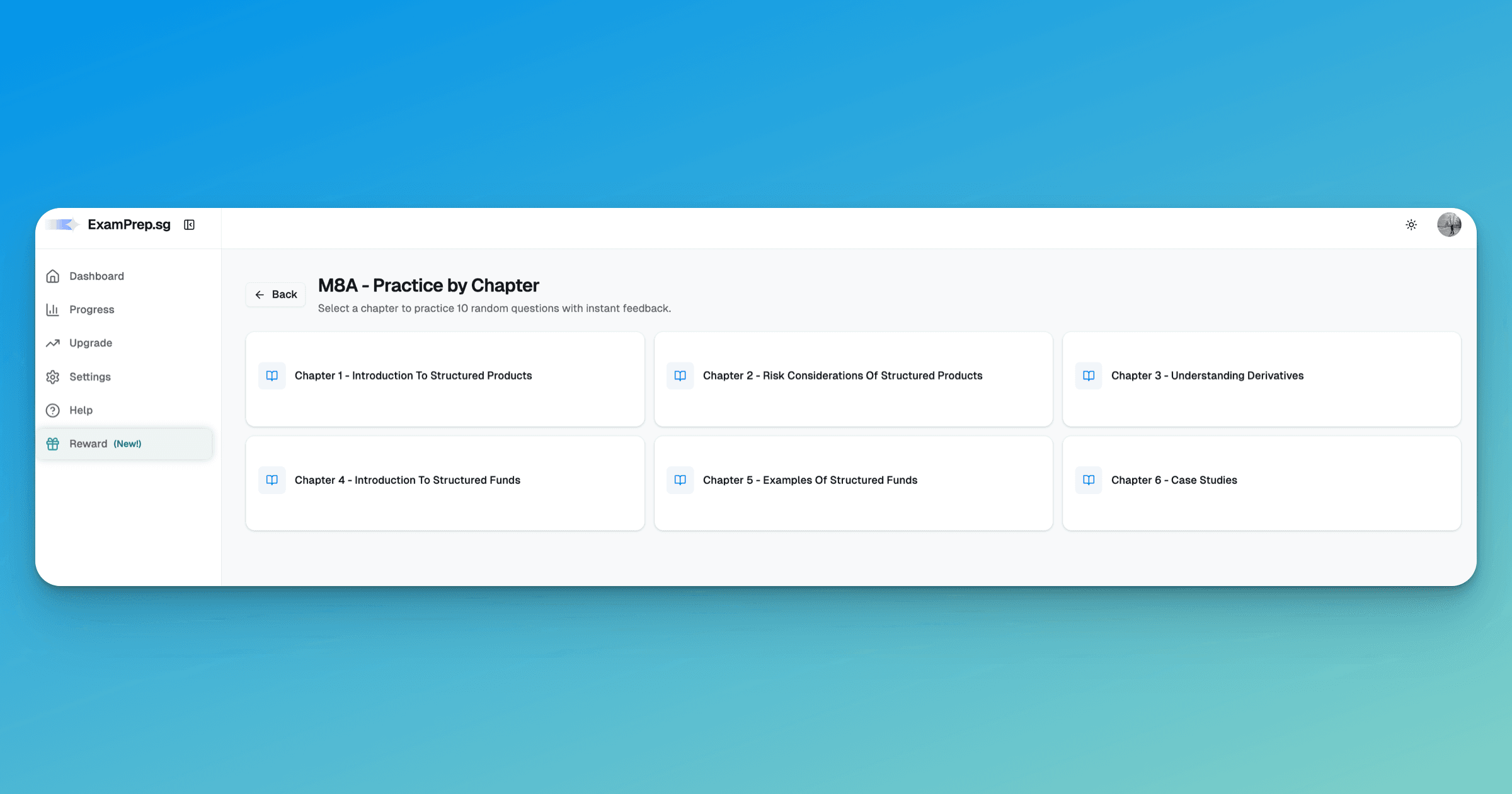

- Target the Math: Focus 80% of your time on Chapter 3, 4, and 5. We offer dedicated drills just for these complex calculations.

Use ExamPrep.sg's "Practice by Chapter" mode to focus on specific chapters.

- Practice Case Studies: Drill suitability questions until you can instantly identify the single most unsuitable risk factor in a given scenario.

If you are ready to tackle M8A with a structured approach, check out our full M8A Study Strategy Guide (2026).

Common Questions on M8A Exam Difficulty

By The ExamPrep.sg Team

Singapore's leading CMFAS and SCI exam preparation platform, helping thousands of candidates pass their financial adviser exams on the first try.

Ready to Put This Strategy Into Action? 💯

Master the M8A calculations with our Exam Platform. Start practicing now.