How to Pass CMFAS M8A Exam (2026 Study Guide & Killer Chapters)

M8A (Collective Investment Schemes II) is where the syllabus gets technical. Here is the 4-week study strategy focusing on Derivatives, Structured Funds, and the crucial Case Studies chapter.

If you have already passed M8, you know that the Collective Investment Schemes papers are heavily weighted toward calculations and regulatory definitions.

M8A, however, is a different beast entirely. It is a paper about Financial Engineering. It moves beyond basic Unit Trusts and demands that you understand how complex products like Derivatives and Structured Funds are built, how they generate payoffs, and how they fail.

Most candidates fail M8A because they treat it like M8—memorizing definitions. To pass M8A, you must master the mechanics. The passing score is 70% (35 correct answers out of 50 questions).

📝 Note: The SCI syllabus features a minor revision effective 24 Feb 2026. Our premium question bank and mock exams have already been fully updated to reflect these latest changes.

✨ TL;DR: M8A Quick Strategy

- Focus: Derivatives (Chapter 3) & Structured Funds (Chapters 4-5).

- The Core Skill: You must understand payoff diagrams. Static notes are useless here.

- Final Challenge: Chapter 6 Case Studies test your suitability recommendation skills.

- Time Commitment: Plan for 4-5 weeks minimum due to complexity.

The M8A Syllabus Breakdown

The syllabus is concise (only 6 chapters), but the content is dense. We break down the syllabus into three primary categories based on historical failure rates.

Category 1: The Theoretical Foundation (Chapters 1 & 2)

- Chapter 1: Introduction To Structured Products

- Chapter 2: Risk Considerations Of Structured Products

These chapters introduce terms like Principal-Protected Notes (PPNs) and Credit-Linked Notes (CLNs). This section is highly focused on documentation, governance, and the regulatory environment.

- Study Tip: Focus on the structural differences between Principal-Protected and Non-Principal Protected products. Expect questions on the liquidity and credit risk that structured products carry. (If you're still wondering whether to buy notes from Carousell, read our guide on the best M8A mock exams and study guides here).

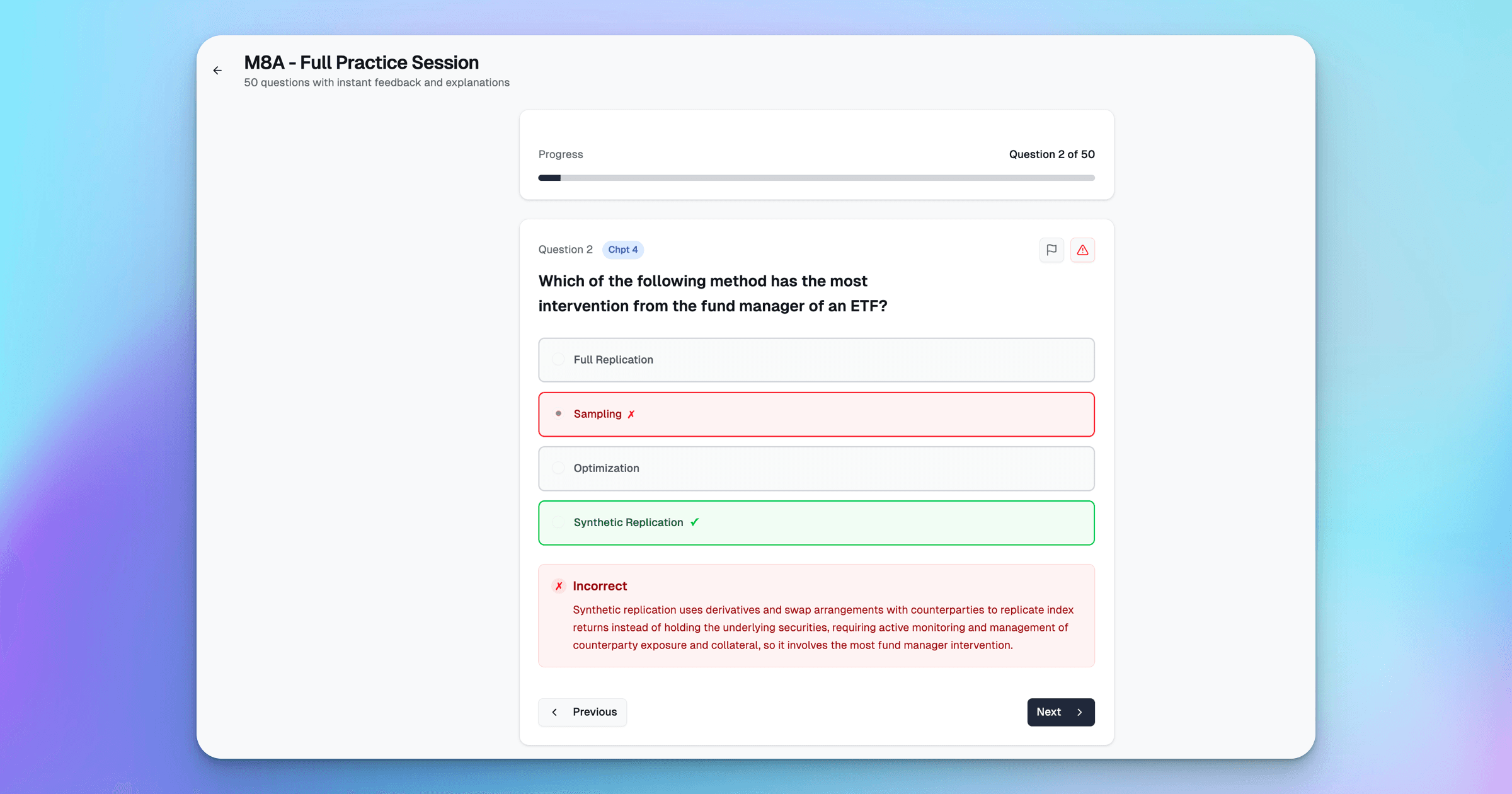

ExamPrep.sg provides instant feedback and explanations to help you understand the concepts better.

Category 2: The Killer Chapters (Chapters 3, 4, & 5)

This is where 80% of candidates fail. You must move from definitions to real-world application.

🎯 Killer Chapter 3: Understanding Derivatives

This chapter is the foundation for everything else in the paper. It covers exchange-traded (Futures, Options) and OTC (Swaps, Forwards).

- The M8A Trap: The exam doesn't just ask for the definition of a Call Option. It asks for the payoff diagram and how that derivative is used as the underlying or component in a Structured Product.

- Must-Knows: Long/Short positions for all four basic derivatives (Forwards, Futures, Calls, Puts) and how to calculate maximum gain/loss.

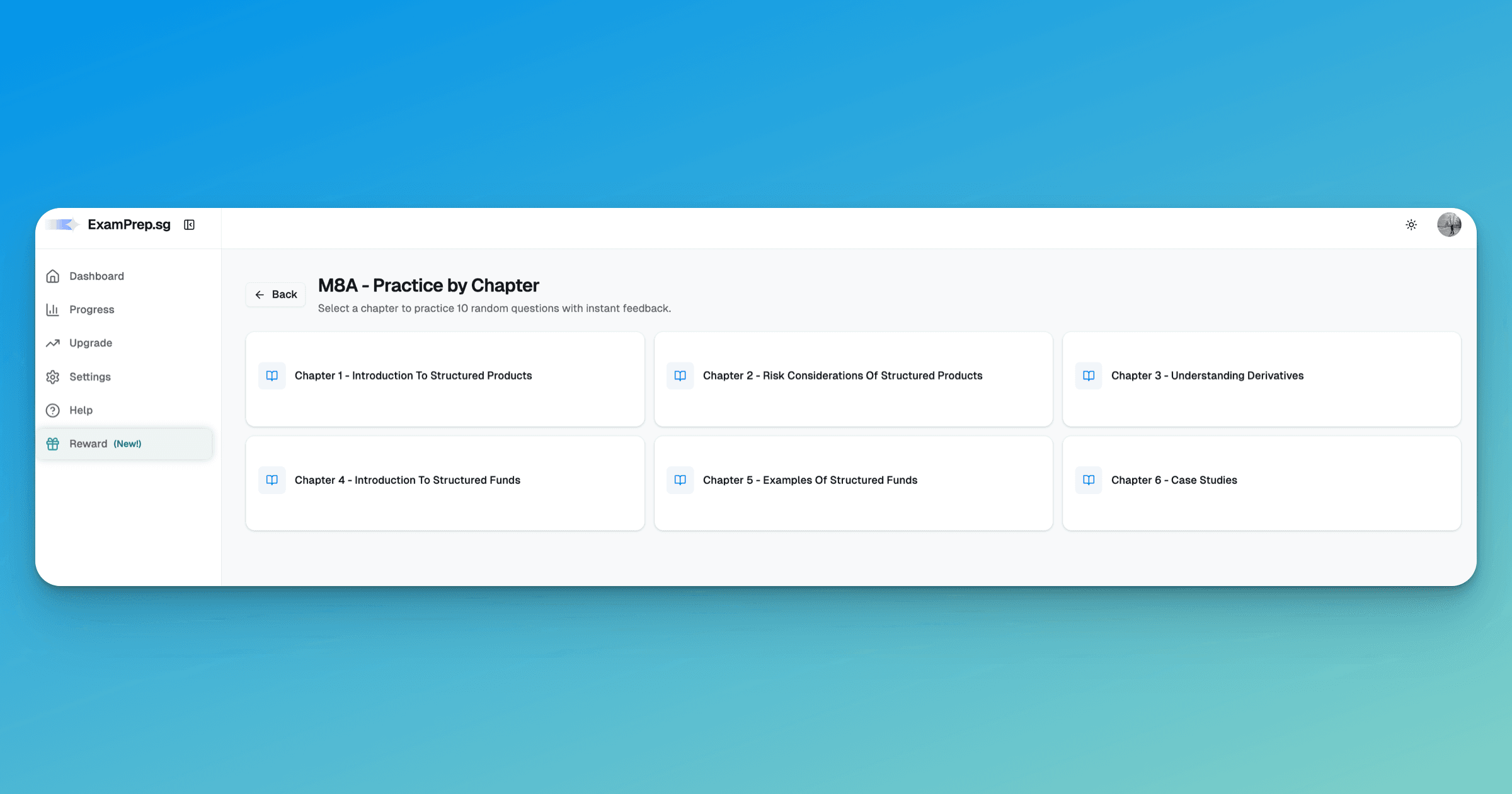

Use ExamPrep.sg's "Practice by Chapter" mode to focus on specific chapters.

🎯 Killer Chapters 4 & 5: Structured Funds

These chapters are about combining the building blocks. Structured Funds are typically built by combining a Zero-Coupon Bond (for capital preservation) and a Derivative (for potential growth).

- The M8A Challenge: You need to analyze the specific components of the fund and assess its performance under various market conditions (rising rates, falling equity). Static study notes fail because they can't simulate this dynamic relationship.

- Must-Knows: The difference between a Guaranteed fund (rare) and a Principal-Protected fund (common) and why the protection relies on the credit quality of the issuer.

Category 3: The Application (Chapter 6)

🎯 Killer Chapter 6: Case Studies

The final section tests your ability to synthesize knowledge and apply suitability rules. You will be given a complex product and a client profile.

- The M8A Test: You must determine if the product is suitable based on the client's Risk Tolerance, Financial Situation, and Investment Objectives.

- Warning: Suitability questions often have two seemingly correct answers. The M8A answer relies on finding the specific regulatory constraint or risk mismatch.

The 4-Week M8A Study Plan

| Week | Focus | Action Plan |

|---|---|---|

| Week 1 | Introduction & Products (Ch. 1-2) | Read the textbook/notes. Create a table comparing PPNs, CLNs, and Structured Funds governance. |

| Week 2 | Derivatives (Ch. 3) | The Critical Phase. Spend 80% of your time here. Use a simulator like ExamPrep.sg to drill on particular chapters to overcome your weaknesses. |

| Week 3 | Structured Funds (Ch. 4-5) | Drill component analysis. Practice calculating the price movement of a fund if the derivative component moves +/- 10%. |

| Week 4 | Application & Exam Simulation (Ch. 6) | Practice Case Studies. Take at least 3 full 1-hour mock exams. Review every single incorrect answer from the Killer Chapters. |

We have also put together free mock questions (the most common and difficult ones) for you to practice here.

Ready to master Derivatives?

You can't identify your weaknesses from a PDF. Our M8A simulator is specifically designed with instant feedback and explanations, as well as a "Practice by Chapter" mode to help you master harder chapters like Chapter 3 and 4.

👉 Start M8A Practice NowUse ExamPrep.sg's progress tracker to see your progress and identify your weak spots.

M8A is challenging, but manageable with the right focus. Prioritize the dynamic math and the structural details over simple memorization.

If you're still debating if this paper is for you, read our deep dive on Is the CMFAS M8A Exam Difficult?

Common Questions on M8A Exam

By The ExamPrep.sg Team

Singapore's leading CMFAS and SCI exam preparation platform, helping thousands of candidates pass their financial adviser exams on the first try.

Ready to Put This Strategy Into Action? 💯

Master Derivatives and Structured Products with our M8A Exam Platform. Start practicing now.